How we are creating Impact

We have aligned our impact objectives with UN SDG Goals to assist investee companies to achieve their financial goals, pivot them towards sustainability & impact objectives and also help monitor the same.

We believe that our process of investing and value creation by supporting the entrepreneurial ecosystem will contribute towards building inclusive & equitable societies.

Impact investments are made in organizations, projects or funds which are generating measurable and positive social & environmental outcomes in addition to financial returns.

Our Investment Philosophy

As operating investors, we wish to move beyond capital infusion, and create an ecosystem, which helps our companies succeed in building sustainable operating cash flow models, and thrives on entrepreneurial passion.

While we are focused on generating financial gains, we wish to leave a larger footprint around the ecosystem we develop. Our companies will be focused on generating a positive socio-economic impact, while operating as "responsible businesses

Impact by Numbers

patients served,

entrepreneurs

created

Efficiently managed

Solar Power Infrastructure,

LPG saved

from

being wasted

Employment created in

Rural & Urban areas,

Cumulative

Women

Empowerment

Artisans were provided

Skills Development Training

Youth

lives impacted by

enhancing & developing skill

Portfolio

Lal10

Lal10 is a B2B Handicrafts marketplace to connect global retailers with Indian artisans/ rural SMEs. Their vision is to become India’s Alibaba for crafts.

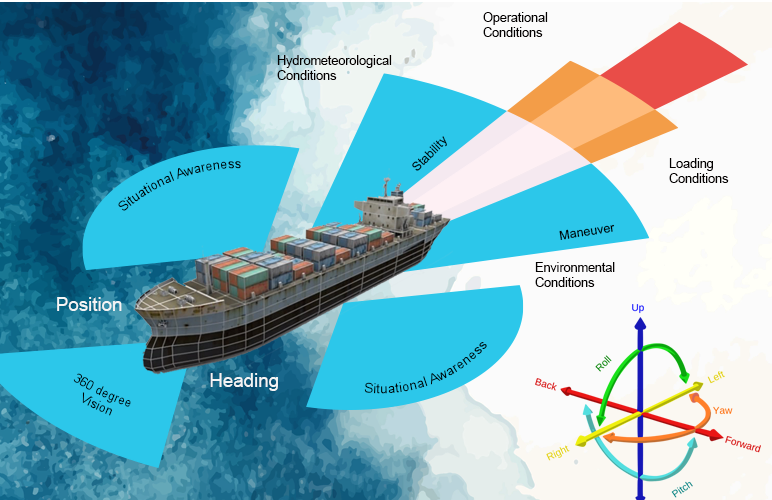

Tardid

Tardid Tech provides industry specific augmented intelligence platform for original equipment manufacturers and government.

Stanplus

StanPlus is an Emergency Response service aiming to make patient mobility and emergency services as efficient as possible across India.

PITCH TO US

Contact Info

Powai, Mumbai, Maharashtra 400076

Olympia building, Technology St, Hiranandani Gardens,